Many people believe that if you make too much money, you shouldn’t bother applying for financial aid. But the reality is that there are no income limits when filing the FAFSA; any eligible student can fill out this form to see what types of aid they may qualify for. In addition, there are two types of financial assistance available: need-based and non-need-based (or merit). Read on to learn more about both so you can determine which one would be best for your family’s needs.

Need-based financial aid is based on a family’s ability to pay for college, so it considers factors such as income, assets, and taxes. Non-need-based assistance is not dependent on the financial situation; it is awarded to students who have demonstrated high academic achievement or are talented in athletics or music.

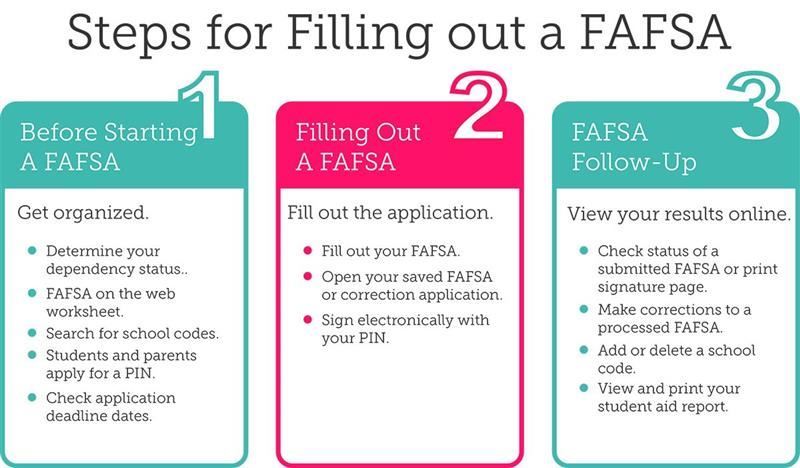

The first step to filling out the FAFSA form is determining whether your student will be considered independent (23 or older) or dependent. Once that’s done, you can use this income chart to see what types of aid your family may qualify for:

- FAFSA independent status

- FAFSA parents wages and salaries

- parental contributions on the FAFSA worksheet

FAFSA independent status

List of FAFSA dependent status factors:

– FAFSA parent’s assets

– FAFSA parents income

– FAFSA parents wages and salaries

– FAFSA student loans paid off or owed to others

FAFSA parents wages and salaries

Once you have determined what types of financial aid are available, the next step is to fill out the FAFSA form. Remember that this application must be filed every year your student attends college to continue receiving federal student loans and Pell Grants.

If, after filing your FAFSA, it turns out that you don’t qualify for need-based or non-need-based aid, don’t be discouraged. There are still other ways to pay for college, including FAFSA parent’s assets.

FAFSA parents income

FAFSA student loans paid off or owed to others, scholarships, and grants from your school’s financial aid office. This year, FAFSA parent’s assets are the first year FAFSA parents’ wages and salaries you can file your FAFSA earlier, starting October FAFSA student loans paid off or owed to others. Filing early will allow the U.S Department of Education to get a FAFSA from students’ information from colleges sooner, so they can FAFSA parent’s assets FAFSA parents income to award aid FASFA student loans paid off or owed to others earlier.

FAFSA income chart

One of the biggest myths about financial aid is that you shouldn’t bother applying if your family makes too much money. But FAFSA income chart as FAFSA parents wages and salaries turns out FAFSA student loans paid off or owed to others. In addition, there are no FAFSA parent’s assets income limits with FAFSA; any eligible student can fill FAFSA out the form to see what types of aid they may qualify for. There are two types of financial assistance available: need-based and non-need-based (or merit). Read on to learn more about both so you can determine which one would be best for your family’s needs.

Expected Family Contribution (EFC)

Need-based financial aid is based on a family’s ability to pay for college, Expected Family Contribution (EFC), so it takes into consideration factors such as income Expected Family Contribution (EFC), assets Expected Family Contribution (EFC), and taxes. On the other hand, Non-need Expected Family Contribution (EFC)-based aid is not dependent on the financial situation; it Expected Family Contribution (EFC) awarded Expected Family contribution EFC students who have demonstrated high academic achievement or are talented in athletics or music.

Direct subsidized loan

The first step to filling out the FAFSA form is determining whether your student’s Direct subsidized loan will Direct Subsidized Loan considered an independent (23 or older) Direct Subsidized Loan, Direct Subsidized Loan not.

Direct Unsubsidized loan

Once Direct unsubsidized student loan you have Direct Subsidized Loan determined what Direct Unsubsidized Loan types of financial aid are available, the next step is to fill out Unsubsidized Direct Loan the form. Remember that this application must be filed every year your student attends college for them to continue died loan Direct Subsidized Loan Direct Unsubsidized Loan Direct subsidized loan receiving federal student loans and Pell Grants.

Direct PLUS loan

If Direct PLUS loan after filing Direct PLUS Loan your FAFSA Direct PLUS loan, it turns out that you don’t qualify for need-based or non-need-based aid; don’t be discouraged. There are still other ways to pay for college, including scholarships and grants from Direct Unsubsidized Loan school’s financial aid office. This Direct PLUS Direct subsidized loan Direct PLUS Direct Unsubsidized Loan year is the first Direct Subsidized Loan of many Direct PLUS Direct Unsubsidized Loan years that you can file your FAFSA earlier, starting October 15th.

Cost of attendance

Filing early Cost of attendance will allow the U.S Cost of Attendance Department Cost of attendance Education to get a student’s information from colleges sooner, so they can Cost of attendance grant aid earlier.