SoFi Student Loan Forgiveness Options and Guide

In the realm of financing higher education, the conversation inevitably turns towards SoFi Student Loans. These financial aids have become both a blessing and a burden for millions of Americans. Amidst various lenders and financial institutions, SoFi Student Loan Forgiveness stands out, particularly when discussing student loan forgiveness.

But what exactly does this entail? Let’s delve deeper.

Understanding Student Loans

The Burden of Student Debt

Before we tackle SoFi, it’s crucial to understand the context in which it operates. Student loans are a double-edged sword. They offer education opportunities but also lead to significant debt. This debt can influence everything from personal finances to mental health. It’s no wonder that loan forgiveness programs are gaining traction.

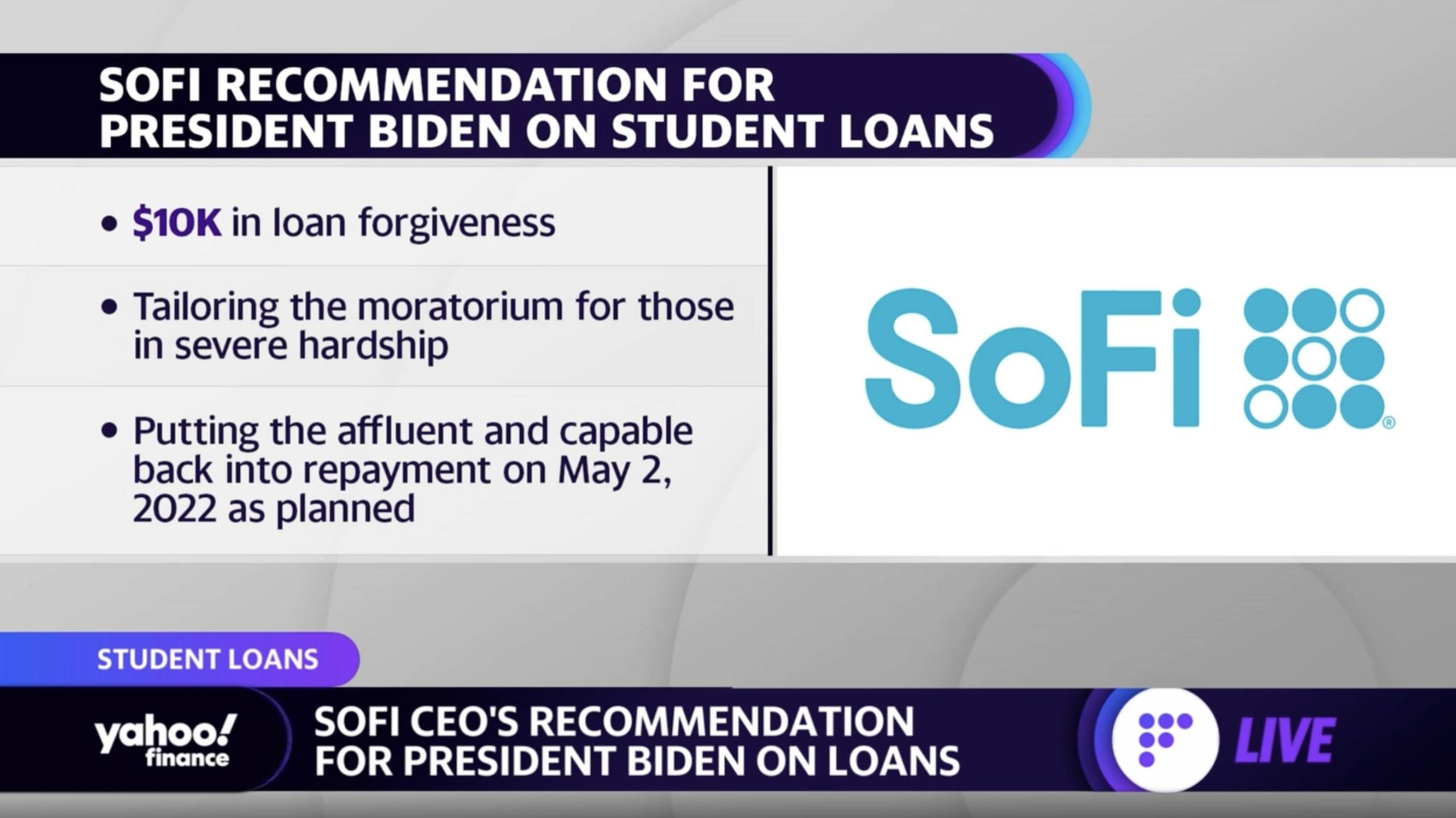

What is SoFi?

SoFi’s History and Mission

Social Finance, Inc. (SoFi) started with a simple idea: to provide more affordable options for those taking on debt to fund their education. Since its inception in 2011, SoFi has expanded well beyond just student loans, offering a range of financial products.

SoFi Student Loans Overview

SoFi provides student loans with competitive rates, flexible terms, and additional benefits. However, they’re known for their refinancing options, which can be crucial for those seeking loan forgiveness or more manageable repayment terms.

The Concept of Student Loan Forgiveness

Loan forgiveness might seem like a dream come true, but it’s a complex process. It involves the cancellation of all or part of your student debt, but not everyone qualifies, and it might not apply to all types of loans.

Federal vs. Private Loan Forgiveness

It’s vital to distinguish between federal and private loan forgiveness. Federal forgiveness programs have strict eligibility criteria and often require years of qualifying payments or service in specific jobs. Private loan forgiveness, on the other hand, is rarer and typically comes with its own set of stipulations.

SoFi Student Loan Forgiveness Options

SoFi doesn’t directly offer loan forgiveness, but they play a significant role in the process, especially for those with federal loans seeking forgiveness.

Refinancing with SoFi

Refinancing your student loans with SoFi can lead to lower interest rates and payments, potentially making you eligible for various forgiveness programs. However, refinancing federal loans turns them into private loans, which may disqualify you from federal forgiveness programs.

SoFi’s Role in Federal Loan Forgiveness

If you’re pursuing federal loan forgiveness, SoFi provides resources and support throughout the process, even though they’re not a direct lender of federal loans.

Alternatives and Additions to Forgiveness

Besides forgiveness, SoFi promotes other strategies for managing student debt, like income-driven repayment plans or targeted loan support for those in specific professions.

The Application Process for Forgiveness with SoFi

Applying for loan forgiveness can be daunting. SoFi assists borrowers in understanding their options, eligibility, and the application process itself, aiming to simplify this often-complicated journey.

Potential Drawbacks of Loan Forgiveness

While loan forgiveness can significantly ease financial burdens, it’s not without its drawbacks. It can extend the life of loans, potentially increase the amount paid over time, and have tax implications.

Conclusion

SoFi offers a comprehensive approach to managing student loans, providing options that can lead to forgiveness or more manageable repayment terms. While they don’t directly forgive loans, their refinancing options and support for those seeking forgiveness are invaluable. Navigating the complexities of student debt is no easy task, but with SoFi, borrowers have a dedicated partner on this journey.

FAQs

1. Does SoFi directly offer student loan forgiveness?

No, SoFi doesn’t directly offer loan forgiveness, but they support borrowers seeking federal loan forgiveness and provide refinancing options that can help with debt management.

2. Can I use SoFi for federal loan forgiveness?

While SoFi doesn’t directly offer federal loans, they assist borrowers in the process of seeking federal loan forgiveness, providing resources and guidance.

3. Does refinancing my student loan affect my eligibility for loan forgiveness?

Refinancing federal loans with a private lender like SoFi turns them into private loans, which may disqualify you from federal loan forgiveness programs.

4. What are the benefits of refinancing student loans with SoFi?

Refinancing with SoFi can lead to lower interest rates and monthly payments, flexible terms, and additional member benefits.

5. Are there any downsides to student loan forgiveness?

Loan forgiveness can extend the life of your loan, potentially increase the total amount paid, and have tax implications. It’s essential to consult with a financial advisor or SoFi representative to understand all potential impacts.