Average Student Loan Interest Rates

How much will an average student loan interest rate affect my monthly payments? This question

is important because it can make or break your college education funding. Here are the average

student loan interest rates for federal student loans from 2023 to 2024:

Undergraduate students – The minimum payment for a college loan is currently at 4% per year.

Under recent legislation, this minimum payment will now increase to 6% per year. Graduate

students – A graduate student loan now has a minimum payment of 7% per year. PLUS loans for

parents and students with bad credit scores – The minimum payment on these loans will be

increased. Repayment after the first six months will now be at 3% of the loan amount.

Private student loan terms are usually determined by your financial aid company. These terms

can either be variable or fixed rates. Fixed rates normally give you a set interest rate for the

entire life of the loan while variable rates fluctuate depending on economic conditions. If you are

planning to apply for government loans, it is best that you go for a fixed rate to ensure that your

repayment will not be affected in any negative way.

Average student loan interest rate federal

Average student loan interest rates for graduates will definitely be higher than those for

undergraduates because they have higher earnings. However, the grace period in which they

can defer the repayment of their loans is more. Under the new legislation, loan repayments

made by graduates will be subsidized by the federal government. Graduates with families are

eligible for the subsidized plan.

You should shop around before going to your prospective lender to finalize the deal. The internet

is the best source for you to obtain the latest information. The summer is the best time to shop

around and compare the average interest rate quotes from different lenders. Many private

institutions also provide their prospective students with online resources that can help them to

make the right decision.

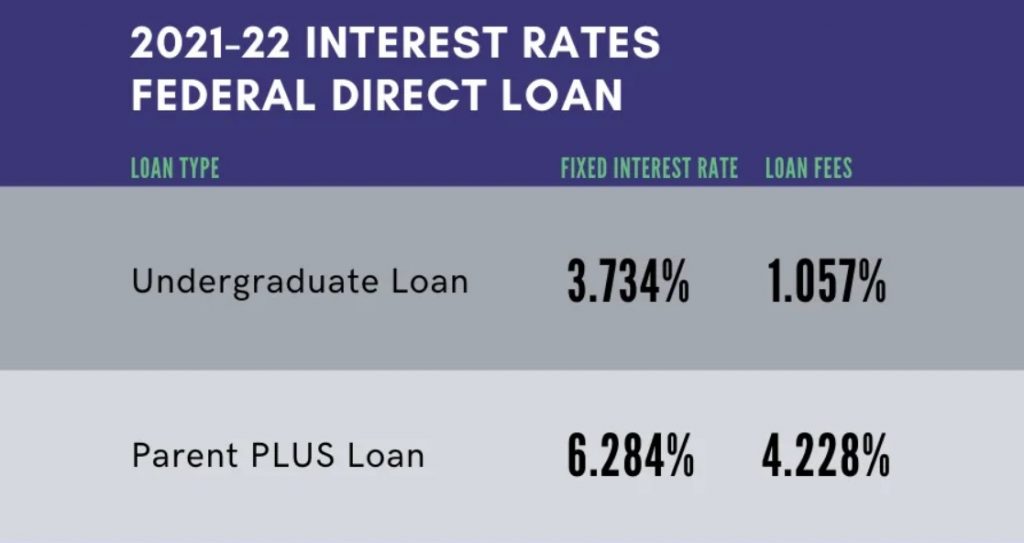

Federal student loan interest rates

Federal student loan interest rates are subsidized. The federal government pays the interest on the loan while the student is in school.

Interest rates are significant to know when you are looking for loans. Subsidized loans provide a fixed interest rate during all repayment periods. However, there is a cap on how much interest can accumulate each month.

Interest rates for unsubsidized loans vary, and the interest rate is determined based on the US Treasury rate.

Loans can be borrowed from banks, credit unions, and other private lenders.

Federal loans provide a fixed interest rate during all repayment periods. The interest rates for unsubsidized loans vary, and the interest rate is determined based on the US Treasury rate.

The maximum amount you can borrow is $31,000 or $57,500. If you are married, you can repay the loan with either monthly or quarterly installments.

The Interest rate will be fixed at 7.99%

You will make payments for ten years, and the loan will be due in full on October 15, 2028

The monthly payment of $482.78 is not enough to dent the debt and increase the deficit.

What are average interest rates on private student loans?

Private student loans are becoming a more popular option for college students. They provide the opportunity to bridge the gap between what families can afford and how much tuition costs. However, private loans also come with a high-interest rate, which means it is essential to know the average interest rates on personal student loans.

The average interest rates on private student loans depend on various factors such as type of lender, borrower’s credit score, and length of time borrowing money. For example, if you borrow $10,000 from a bank and pay it off over ten years at 11% APR (annual percentage rate), your monthly payments will be $204.

If you instead borrow $10,000 from a credit union and pay it off over ten years at 14% APR (annual percentage rate), your monthly payment will be $140.05.

There are too many factors to say with certainty what your monthly income will be, but as a general rule of thumb, if you have a job and your gross income is 2.5 times the amount of the loan you want to take out, you should have no problem paying for it. For example, if you’re going to take out a $10,000 loan, your monthly gross income should be at least $25,000.

There are many advantages associated with the grace period. First, subsidized federal loans

have a lower repayment cost, so students who opt for subsidized federal student loans will be able to

afford their education at lower costs. For students with parents, this is the greatest benefit, since

the parents will be able to take care of their children during the grace period. In addition, during

this time, the student does not need to make the repayment, as long as he or she follows the

requirements and completes the requirements indicated in the agreement.

If you are a graduate, you are encouraged to apply for student loans first, before proceeding to

the part of getting the consolidation of the loans. Graduate students usually have financial needs

such as food, accommodation, books, and other incidental expenses. They may also be eligible

for student loans with low-interest rates, as long as they satisfy the eligibility criteria. This helps

the graduate to get rid of the burden of debt in a convenient manner. Most of the available loan

options can be availed if the borrower is a graduate, but the repayment period needs to be taken

into consideration.

How has the coronavirus impacted student loan interest rates?

The US economy is in a state of turmoil thanks to the coronavirus, and for this reason, many interest rates have dropped to near-record lows. The new Fed rate cut also applies to student loans. Many private companies lowered their rates, too, not just the federal government. Regarding 2020/21 and 2021/22 school years, the fixed rates are roughly 3% lower than last year. The variable rates are about 4% lower compared to the previous year’s rate changes.”

“We’re still in an environment where rates remain remarkably low. The student loan business is the perfect example., A Washington Bureau Chief and Senior Economist for Bankrate, John Dunham is also a student loan expert. This clip provides an overview of the current federal student loan interest rates.

The Biden presidency’s effect on student loans

Since the president doesn’t influence student loan interest rates, Joe is taking other routes to make college more affordable. Recently, he has suggested a couple of different ways to help students that go beyond a student loan., as well as two years of tuition for low-income students at historically Black colleges, tribal colleges, and minority-serving institutions.

He has also been looking at ways to help reduce existing student loan debt. Forgive measures that apply only to government-backed loans, however.

How can I reduce my student loan interest rate?

The Federal Direct Loan offers a variety of repayment plans and features to help you make your student loan payments more affordable.

If you’re looking to minimize your student loan interest rate, you have a few options:

- Improve your credit score before applying: If you’re applying for a loan from a private lender, they’ll likely conduct a credit check to determine the rate you’ll get. The better your credit score, the lower that rate will be.

- Add a co-signer: Many student loan borrowers have poor credit. If you are in this situation, adding one or more people with good credit to your loan could be the solution. This will give you a better chance of getting affordable monthly payments and can help you qualify for discounts on other goods and services.

- Variable rates can be risky, but they can also result in a better rate during an economic downturn. Just keep in mind that the opposite could happen, and you’ll have to keep paying your mortgage even if your interest rate has risen.

- One strategy you might want to consider is refinancing your old loans. If you took out a student loan when interest rates were high, you might be able to reduce the interest rates by refinancing into one that has lower rates. This is especially true if your credit score has improved since the first time around.

The federal loan consolidation programs for graduates are different from the other options

because the borrowers are required to use the income-driven repayment plan. This is the most

popular repayment plan chosen by borrowers because the program offers flexible and affordable

repayment options.

With the income-driven repayment plan, borrowers have to calculate the

total income they receive every month, including their dependents’ incomes, and apply it to the

monthly repayment. After applying, they have to submit an application and wait until their loans

get consolidated. When their loans get consolidated, the new debt incurred gets added to the

loan balance, making it easier for borrowers to pay off their loans.