What is FFELP Loan Forgiveness Program?

The FFELP loan forgiveness program allows borrowers to have their federal student loans forgiven after making a certain number of qualifying monthly payments. To be eligible for FFELP loan forgiveness, you must first consolidate your FFELP loans into a single Direct Consolidation Loan. Then, you must make 120 qualifying monthly payments (10 years of payments). After making 120 qualifying monthly payments, you can apply for FFELP loan forgiveness.

The FFELP loan forgiveness program is a great way to get rid of your federal student loans. By consolidating your FFELP loans into a Direct Consolidation Loan and making 120 qualifying monthly payments, you can have your FFELP loans forgiven. FFELP loan forgiveness is a great motivation to keep up with your monthly payments because the result is that you will be able to have your FFELP loans paid off. In addition, FFELP loan forgiveness is a generous program that can help borrowers struggling financially.

As the benefits of FFELP loan forgiveness go, it can greatly relieve those burdened by their FFELP loans. FFELP loan forgiveness offers the potential of complete loan discharge, which erases the remaining balance on your FFELP loans. Forgiveness through FFELP is not automatic, but you may qualify if you meet the right criteria. FFELP loan forgiveness is an option for those borrowers who have made 120 monthly payments on time. The FFELP loan forgiveness application is available through the Department of Education.

When seeking FFELP loan forgiveness, you will need to provide detailed information on your FFELP loans and monthly payments. You must also certify that you meet all the FFELP loan forgiveness requirements. The FFELP loan forgiveness application is a straightforward process, but you will need to provide information on all of your FFELP loans. Be sure to gather all the information you need before starting the FFELP loan forgiveness application process.

If you are interested in FFELP loan forgiveness, be sure to contact the Department of Education for more information. The Department of Education can provide you with all the details you need on FFELP loan forgiveness, including applying and what requirements you must meet. FFELP loan forgiveness is a great way to get rid of your federal student loans, so be sure to take advantage of this program if you are eligible. FFELP loan forgiveness is a generous program designed to help FFELP loan borrowers struggling financially.

With FFELP loan forgiveness, you can have your FFELP loans paid off after making 120 monthly payments. The FFELP loan forgiveness application is available through the Department of Education. To be eligible for FFELP loan forgiveness, you must consolidate your FFELP loans into a Direct Consolidation Loan and make 120 qualifying monthly payments. FFELP loan forgiveness is a great way to get rid of your federal student loans.

How do I know if I have FFELP Loans?

To determine if you have FFELP Loans, you must gather your loan information. This includes the lender’s name, the type of loan, and the amount of each loan. You can find this information on your federal student aid report (SAR). The SAR is a document that lists all of the loans you have received for college.

If you do not have your SAR, you can request a copy of your report by visiting the National Student Loan Data System (NSLDS). NSLDS is a government database that contains information on all federal student loans and grants. You can visit NSLDS to get a copy of your SAR.

Once you have your loan information, you can determine if you have FFELP Loans. If your lender’s name is not listed on the Department of Education’s website, then you have FFELP Loans. If the type of loan is not listed on the Department of Education’s website, you have FFELP Loans. And finally, if the amount of the loan does not match the Department of Education’s numbers, then you have FFELP Loans.

What are the benefits of FFELP Loan Forgiveness?

There are many benefits to FFELP loan forgiveness. Eligibility for FFELP loan forgiveness will erase any remaining debt on your loans and allow you to start with a clean slate. You will no longer have to worry about your loans, and you can use the time you would have spent making payments on something valuable. You can also take advantage of FFELP loan forgiveness if you struggle financially. Many borrowers need help because their monthly income for FFELP Loans is too high under standard repayment.

FFELP Loans & the CARES Act

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a federal law that allows employees to keep their health insurance coverage after they leave their job. The COBRA law has been amended over the years, and the latest amendment is called the CARES Act. The CARES Act amends the COBRA law and makes it easier for employees to leave their job without medical bills.

The disadvantages of FFELP Loan Forgiveness

There are some drawbacks to FFELP loan forgiveness:

- You must consolidate your FFELP Loans into a Direct Consolidation Loan to qualify for FFELP loan forgiveness. If you do not reduce your loans, you will not be eligible for FFELP loan forgiveness.

- You must make 120 qualifying monthly payments to qualify for FFELP loan forgiveness. If you miss a payment or stop making payments, you will no longer be eligible for FFELP loan forgiveness.

- The Department of Education limits the amount of FFELP Loans you can have forgiven under FFELP loan forgiveness.

The Department of Education does not forgive full amounts for all loans, but it will increase your monthly payment under standard repayment to meet this goal.

There is still hope if you cannot make payments on your FFELP Loans. You may qualify for FFELP loan forgiveness, and you should speak with a student loan expert immediately. Applying for FFELP loan forgiveness can take several months, and you do not want to be stuck paying for FFELP Loans when your other options are available. You should contact a local attorney or bankruptcy lawyer before taking action on your FFELP Loans.

Conclusion

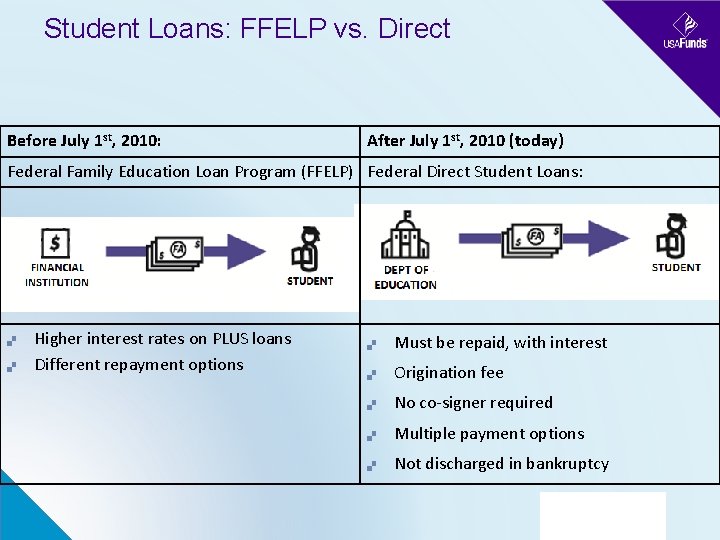

FFELP Loans are federal student loans that were available before 2010. Since then, all new FFELP Loans have had different benefits and requirements than the original loans. FFELP Loans are still granted to borrowers by private lenders, but they must be part of a Direct Consolidation Loan to qualify for FFELP loan forgiveness.